Borrowing cash could be a serious responsibility in spite of what form of loan you decide on. The times of walking into your neighborhood bank or depository financial institution and quickly and simply obtaining a private loan ar just about over. Several guides throughout the web scan over the most points than the finance is secured against your property which individuals failing to stay up with repayments face the danger or retrieval.

Lenders typically issue loans secured by a selected item of private property. This item could be a house, a car, a boat, or perhaps stocks or bonds. Once property is employed to secure a loan, the investor maintains possession rights within the plus till the loan gets repaid. The plus are often oversubscribed and liquidated by the investor if the loan or its interest isn’t repaid by the receiver. All loans come back below the which means of secured loans that incorporates a security in situ. The loans that are extended while not taking any security ar referred to as unsecured loans. If you hit monetary bother and you couldn’t repay your mortgage and secured loan, your mortgage investor would be initial in line for any sale issue following a retrieval. However once the mortgage investor had been paid off, your secured loan supplier would be next to receive payment from the sale issue.

People tend to be notably suspicious of secured loans. The final concern is that if the receiver is unable to repay the loan, his or her home could also be repossessed. This is often true in sure worst-case eventualities, however providing you retain up along with your repayments, doing away with a secured loan may unlock the money you wish with less trouble than different kinds of credit.

Advantages of Secured Loan

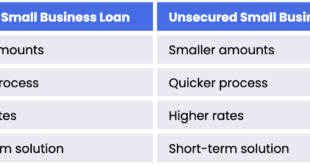

Secured finance represents a lower risk for the investor, as a result of the plus ensures compensation just in case of default. This ends up in lower interest rates than unsecured equivalents, and fewer strict necessities on credit rating and debt-to-income magnitude relation. The previous purpose means secured loans could also be easier to induce than those requiring a lot of rigorous checks.

Larger amounts are often borrowed, and it’ll typically be potential for compensation periods to be longer. Bigger flexibility is additionally offered: personal assets are often used as collateral for a bank loan, which means finance are often secured to grow a business in its early stages. Secured finance product are regulated by the monetary Conduct Authority (FCA) and lined by the monetary investigator Service, providing bigger peace of mind to the receiver.

- Payments ar unremarkably unfolded over a extended amount of your time providing you with a lot offlexibility with compensation of the loan.

- You can typically borrow larger amounts of cash compared to an unsecured loan.

- Since you’ve got to produce collateral for a secured loan, lenders are going to be assured that they’ll get their a refund if you default the loan.

- You can borrow larger amounts as a result of lenders ar assured that they’ll get their a refund, either from loan repayments or sale of the property.

- Secured loans generally go together with a lower interest rate than unsecured loans as a result of the investor is seizing less monetary risk.

- Some kinds of secured loans, like mortgages and residential equity loans, permit eligible people to requiretax deductions for the interest paid on the loan every year.

- If you choose to require out a secured loan instead of remortgage you’ll be able to avoid the potential downside of losing any special rates presently enjoyed on your existing mortgage deal.

- Changing your mortgage to boost additional funds may mean facing massive early compensation charges, doing away with a secured loan facilitate to avoid this.

- A secured loan are often used for any purpose as long because it is legal, raising additional funds via a remortgage could have usage restrictions

Generally, secured loans are meant for people who are denied unsecured loans. Once used properly, they’ll help build your credit score and credit history. Banks conjointly like them as a result of there’s less risk concerned. Lower interest rates are another advantage of selecting a secured loan. As mentioned, a secured loan could be a good way to build your credit. However, it’s vital to create positive you pay everything on time in order that you’ll be able to see a distinction in your score.

From the receiver angle, secured loans ar significant as a result of they assist them bring home the loans at favorable terms and conditions. Most significantly, the value of funds is lower compared to unsecured loans. Secondly, the compensation terms also can be tweaked to some extent with mutual consent between the receiver and therefore the investor.