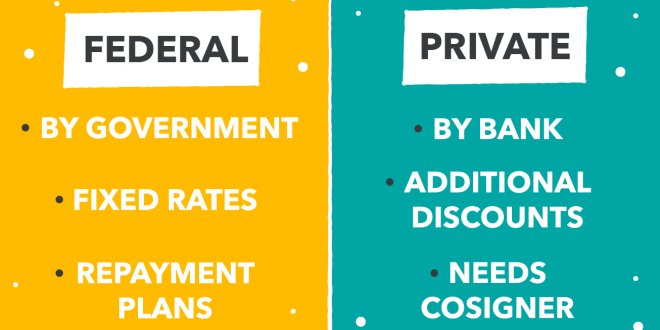

Though there are 2 major sources of student loans — federal and personal. For several individuals, a school education is not possible to get while not borrowing cash to acquire it. Non-public student loans are accessible, however each knowledgeable, even those that work for banks and credit unions, advise students to exhaust all avenues for federal aid initial. Even once narrowing your focus to federal student loan choices, there are a half-dozen completely different choices with varied eligibility necessities, interest rates, and most borrowing amounts.

There are plenty of choices for college students who would like loans to attend college. The foremost necessary factor is that they notice the coed loans that are right for them and their distinctive scenario. By knowing what’s accessible, students will create the correct selection for his or her wants.

Types of Student Loans

- Federal Student Loans

- Private Student Loans

Federal Student Loans

Federal loans are provided by the govt, whereas banks, credit unions and states create non-public loans and finance loans. Federal loans are additional versatile overall. The actual loan that’s best for you depends on factors like your monetary would like, year in class and whether or not you have got a credit history. Stafford and Perkins loans are federal loans given on to the coed. This sort of loan, that is funded with government cash, comes with low interest rates and favorable reimbursement choices. It additionally needs no credit check or collateral.

It’s necessary to clarify what makes federal student loans distinctive to non-public choices.

- Interest rates are typically lower and continually fastened.

- Credit checks and cosigners are largely inessential.

- Flexible payment plans and loan forgiveness programs may be accessible.

- Consolidating multiple federal loans will lower a monthly payment if the reimbursement arrange is extended.

For instance, several of the federal student loans supply a lower than non-public loans. However, most of the federal loans have additional necessities and limits, like additive limits or the quantity you’ll borrow during a explicit loan program. The great news concerning the centralized loans is that there are many alternative programs accessible to assist you if you’re having trouble repaying these loans. The dangerous news is that the centralized has extraordinary powers to collect student loans if you default. To induce federal loans, fill out the Free Application for Federal Student Aid, called the FAFSA. You’ll apply for personal or finance loans directly with the bank or financial organisation you wish to borrow from.

Federal Student Loan Repayment Plans

- Standard Repayment Plan (10 to 30 years)

- Graduated Repayment Plan (10 and 30 years)

- Extended Repayment Plan (Up to 25 years)

- Income-Driven Repayment Plans

The federal loan program is strong and offers many alternative styles of student loans. Although specific eligibility necessities vary, you could qualify for one or additional of the subsequent styles of federal student loans.

- Direct PLUS loans

- Parent PLUS loans

- Federal Perkins Loans

- Direct subsidized federal loans

- Direct unsubsidized federal loans

- Direct Consolidation Loans

Private Student Loans

Even some non-public lenders can tell you to think about confiscating federal loans before deliberation their own product. Those self same non-public lenders, however, can gift their student loan choices as customizable to your monetary scenario, whereas positioning the federal government’s as one-size-fits-all. However, most of the time these loans need that you just have a decent credit score to qualify for a loan, or that you just have a cosigner will. Plus, you and your cosigner’s credit can have an effect on the interest rate that you just receive, whether or not you select a hard and fast rate or a variable Apr.

Private loans are very not a decent plan unless the coed is unable to qualify the least bit for any federal loan that is very unlikely. Co-signers may bog down with the payments or students wages may well be fancy because the loaner takes back the cash he or she lent.

Private Student Loan Repayment Plans

- Full Deferment

- In-School Interest Only

- Fixed Monthly Payments

- Immediate Repayment

Types of Private Student Loans

Private loans are accessible for specific circumstances if you wish them.

- Bar Exam Loans – These loans cowl expenses ancient student loans won’t.

- International Student Loans – Students who aren’t U.S. voters typically won’t qualify for federal student loans.

- Medical Student Loans – Private student loans might supply lower interest rates than federal loans for medical students with smart credit.

- Student Loans for Bad Credit – Most federal student loans don’t need a credit check, thus they’re your most suitable choice.

- Student Loans without a Co-Signer – Undergraduates above all typically would like a co-signer but a few lenders can assess your ability to repay per factors on the far side credit history.

- State Loans – Many states supply their own loan programs, however they typically behave additional like non-public loans than federal loans.

- Credit Union Loan – Credit unions and community banks supply non-public loans, too.