You’re needed to repay your student loans with interest. Interest is calculated as a proportion of the quantity you borrowed. You’ll be able to deduct interest paid on your eligible student loans on your federal instrument, that may scale back your rateable financial gain. The longer you are taking to pay off your loan, the a lot of interest can accrue, increasing the quantity you may ought to repay. Interest rates vary counting on the sort of loan and investor, more over because the year the loan was disbursed if it’s a FFELP or loan from the U.S. Department of Education. These details ar typically found within the agreement and disclosures you received after you took out your student loan.

Average Student Loan Interest Rate

The average student loan rate is 5.8% among all households with student debt, consistent with a 2017 report by New America, a noncommercial, independent company. That features both federal and private student loans — regarding ninetieth of all student debt is federal. Before applying for a loan, it’s necessary to grasp what determines your rate offers. For federal loans like direct backed and direct unsubsidized that ar received through FASFA, interest rates ar mounted by the govt. These will solely be modified by Congress and federal law.

If you select to not pay the interest that accrues on your loans throughout sure periods after you are chargeable for paying the interest (for example, throughout a amount of deferment on an unsubsidized loan), the unpaid interest could also be capitalized. There are ways that to avoid wasting cash on interest, as well as refinancing student loans to a lower rate or paying off your loans a lot of quickly. Once you absolutely perceive how student loan interest rates work, you’ll be able to produce an idea that works for your finances and helps you pay less interest over time.

New Interest Rate

The rate on new college boy loans can rise to 5.05% for the 2018-2019 year, up from 4.45% last year. For graduate students, loans can go along with a 6.6% rate, compared with 6% currently. Here are five ways that to chop those interest rates.

Student Loan Refinancing

With student loan refinancing, you’ll be able to mix your existing federal and personal student loans into a replacement, single student loan with a lower rate. Here are following criteria whereas refinancing:

- Lender interest rates

- Lender repayment terms

- Total savings from student loan refinancing

- Customer service

Strong Credit

If you have got stronger credit, you’re viewed as a accountable receiver and a lot of possible to repay your student loans. Therefore, lenders read you as less of a credit risk.

Variable Rate Loan

A fixed rate implies that the rate can ne’er modification throughout the term of the scholar loan. A variable rate implies that your student loan rate can rise or fall with movements in interest rates.

Shortest Repayment Term

The sooner you repay your student loans, the earlier the investor gets paid back. Which means the investor is taking less risk with its capital.

Co-Signer

Most student loan lenders can enable you to use with a professional co-signer. Their robust credit and financial gain profile will assist you get approved and obtain a lower rate.

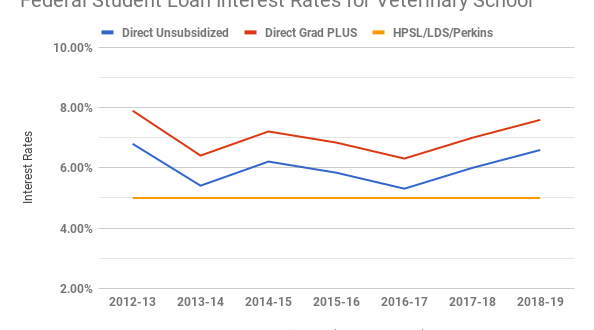

Why Loan Rates are Increasing

Federal student loan interest rates reset once a year. Interest rates, in general, are on the increase over the previous couple of years, that the bump in value of borrowing is not a surprise. Student loan interest rates are possible to continue rising, as long as we have a tendency to stay during this rising-rate surroundings.

When Payments Begin

Most student loans have a provision referred to as in-school deferral and don’t need you to create any payments till you permit school or drop below half-time enrollment. Interest accrues throughout deferral and is more to your loan balance, increasing your monthly payments once deferral ends.

Repayment Options

How long you’ll have to be compelled to repay your loan depends on your investor. A non-public investor would possibly provide you with fifteen years when deferral ends. Federal loans have many reimbursement plans. Income-Contingent and Income-Sensitive reimbursement plans conjointly vary along with your discretionary or annual financial gain.

If the loan had came from a billboard or non-public investor instead, you may be landed with huge fat arrangement fees, hefty penalties for missing repayments, moreover as interest therefore high it comes with a parachute.

Not Eligible for Interest-Free

- You are listed in regular studies however even have regular employment throughout your study amount.

- You submit notification of interest-free standing when your study amount finish date.

- You owe outstanding interest.

- You are restricted because of a review of the knowledge you provided.

- You have reached the lifetime most weeks for interest-free standing.