Direct Stafford Loans are student loans that must be repaid and are on the market to each college man and graduate students. To qualify for an immediate Stafford Loan, you initially got to complete the Free Application for Federal Student Aid (FAFSA). Applying for the FAFSA is free and if you qualify your college can send word you. There are 2 classes of Direct Stafford Loans: sponsored and unsubsidized. What’s the first distinction between the two?

Subsidized Direct Stafford Loans

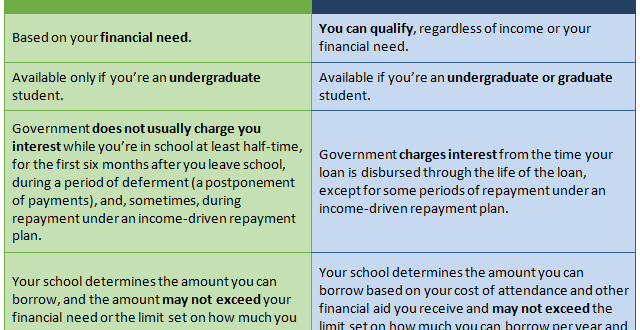

Subsidized Stafford Loans are on the market to solely college man students and are primarily based on money would like. The govt covers the interest payments whereas you’re registered in class a minimum of half-time, throughout the six-month grace amount and through periods of deferment.

Key benefits:

- Eligibility relies on incontestible money would like, as determined by the FAFSA

- The central pays the interest after you are in class a minimum of half-time, throughout the grace amount, and through periods of authorized deferment.

- No payments whereas you’re registered in class a minimum of time

- Multiple repayment plans (including income-based) available

Unsubsidized Direct Stafford Loans

Unsubsidized Stafford Loans are available to undergraduate, graduate and skilled students and aren’t primarily based on money would like. Interest on unsubsidized loans is another to your loan balance whereas you’re in class, throughout the six-month grace amount and throughout periods of deferment. However, you’ll value more highly to pay the interest rather than material possession it accrue, which can cut back the quantity of interest you may pay over the lifetime of the loan.

Credit Score

Your credit score doesn’t matter once applying for a Stafford Loan. Not like for most private student loans, there is not any minimum financial gain to qualify. However, you need to be registered a minimum of half-time during a college that participates within the loan program, and you need to be finishing a course of study that may cause a certificate or degree. Students who wish to use for Stafford Loans should complete a Free Application for Federal Student Aid (FAFSA).

Interest Rate

Federal Stafford Loans have mounted interest rates and may be sponsored or unsubsidized. Though the govt pays interest on sponsored loans whereas students are in class or whereas loans are in deferment once graduation, students area accountable for paying interest on unsubsidized loans, and any unpaid interest is another to the loan balance.

Application Process?

You apply any time throughout the year, however getting a loan might take many weeks. There are 2 basic ways of application — paper and electronic. Your college can tell you which ones technique it prefers. Every technique begins with filing the Free Application for Federal Student Aid (FAFSA).

Borrow Limit

The amount that you simply will borrow with an immediate Stafford Loan depends on whether or not you qualified for an unsubsidized loan or a sponsored loan. The overall quantity is decided by your college and can’t exceed your money would like looking on that loan kind you receive.

Repayment Options

Like all federal student loans, Stafford Loans are eligible for several repayment plans offered by the Department of Education. These include:

- Standard Repayment: Borrowers pay a hard and fast quantity for ten years

- Extended Repayment: Borrowers will repay over twenty five years if they owe quite $30,000 in Direct Loans

- Graduated Repayment: Borrowers repay their loan over 10 years, however payments begin tiny and increase each 2 years, ideally as financial gain rises

- Income-Based Repayment: Monthly payments are primarily based on house financial gain and family size. The utmost repayment amount of is between twenty and twenty five years

Other eligible repayment plans:

- Standard Repayment

- Extended Repayment

- Graduated Repayment

- Revised Pay-As-You-Earn (REPAYE) Repayment

- Pay-As-You-Earn (PAYE) Repayment

- Income-Based Repayment (IBR)

- Income-Contingent Repayment (ICR)

- Income-Sensitive Repayment (ISR)

How to Qualify

To qualify you need to be meet the subsequent guidelines:

- Be a U.S. citizen, a national or permanent resident

- Be registered a minimum of half-time in an authorised establishment

- Stay in smart educational standing

- You have a money would like (for sponsored loans)

Independent Students

If you’re a dependent student whose oldsters have applied for, however were denied a Loan, or if you’re a freelance undergraduate student, you will be eligible for an additional Unsubsidized Federal Direct Stafford Loan quantity. However, a student might ne’er borrow quite the value of education minus the other assist received.

Benefits of Direct Student Loan

Here are a number of the numerous advantages of federal student loans:

- Federal student loans supply low, mounted interest rates that don’t rely on your credit scores which don’t need a cosigner.

- Federal student loans could also be accustomed purchase tuition, fees, textbooks, supplies, housing, food, transportation, a computer, and alternative faculty prices.

Disadvantages of Subsidized Student Loans

Of course, there’s no such factor as a gift, and sponsored student loans go with some drawbacks additionally. The most important is solely that in spite of what number engaging options they provide, you’re still absorbing debt. And while it’s certainly possible that the advantages of the education you receive will outweigh the prices, absorbing debt is usually a choice that ought to be created fastidiously. Most student often